COURTESY CANOPY REALTOR® ASSOCIATION

Aug. 14. By Dave Yochum. As we enter the sixth month of the COVID-19 pandemic, the world continues to feel upside down. For one thing, the spring housing market transitioned to the summer, and Realtors say it’s been hot.

“June and July closed home sales exceeded the same months in 2019, despite COVID,” said Allen Tate CEO Pat Riley. “Unlike many industry sectors, the recovery of the residential real estate market has been a sharp turnaround.”

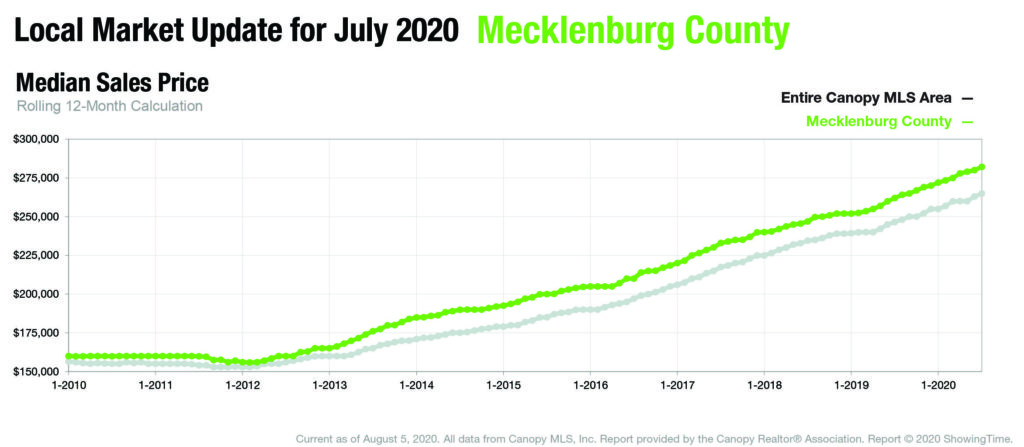

Nationwide, pending sales are up nearly 17 percent year over year and price growth is accelerating. More new listings were added to the market last week than the week prior, but not enough to keep up with the pace of sales as total inventory fell further below where it was last year, according to Zillow.

PAT RILEY

That strong buyer demand has been evident in both urban and suburban areas of the country during the coronavirus pandemic.

To put a fine point on it, sale prices nationally decelerated 6 percentage points more in urban areas than in the suburbs, according to Zillow. Pre-coronavirus, the suburban median sale price was up 6.4% year over year and urban median sale price was up 9.3% year over year. By the end of June, that price growth had fallen to 3.3 percent and 0 percent, respectively.

But COVID-19 doesn’t necessarily mean more buyers will be moving to the suburbs and working from home over the long-term. Riley said buyers will still make their housing decisions on evergreen factors like school report cards – regardless of what home style or physical location they prefer.

Riley said the residential real estate market here is recovering quickly because there is a “perfect storm” of interest, demand and low interest rates.

Moreover, people want to move to North Carolina for work, family, or quality of life reasons, he said.

Inventories and interest rates

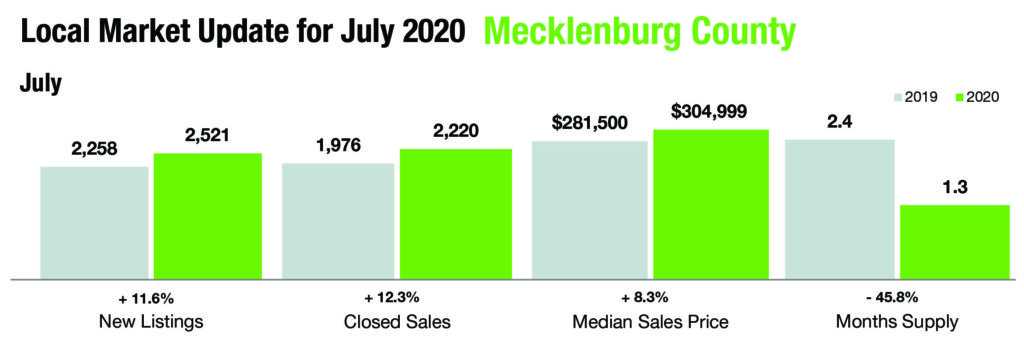

Inventory is low, and properties are selling quickly. Inventory is down a whopping 42.4 percent, according to Canopy.

According to new data from Freddie Mac, the 30-year fixed-rate average is 2.96 percent with an average less than 1 point in fees. The 30-year fixed average, while climbing slightly, has remained below 3 percent for four of the past five weeks.

It was 3.60 percent a year ago.

“Low, low interest rates have infused energy into the market and are expected to remain until 2021,” Riley said. As of May 3, 2020, new listings were down 39 percent compared to the same time last year, according to Zillow data.

Pending and DOM

Canopy, the Charlotte Regional Realtors Association, says July pending sales were 20 percent ahead of July last year. Cumulative days on the market were down 15.4 percent during the same period, while average list price—more than $417,000— was 18 percent higher than one year ago.

COURTESY CANOPY REALTOR® ASSOCIATION

Discussion

No comments yet.