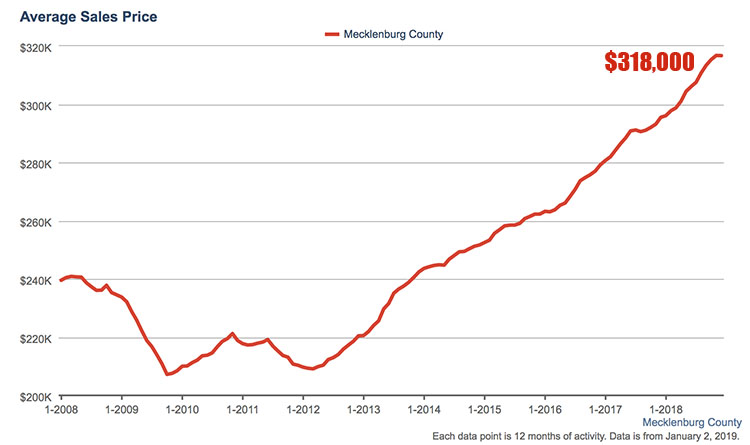

Jan. 9. By Dave Yochum. The go-go housing market has been great news for sellers in Lake Norman for years. But now, for owners, the tax man cometh. Quickly appreciating values, up 5 percent from October of 2017 to October of 2018, according to Case-Shiller, will be reflected in new valuations coming from Mecklenburg County this month.

The government wants its share.

“I think the revaluation will open up a lot of people’s eyes to what their properties are really worth. There has long been a disparity between taxable value and actual value in the marketplace,” says Davidson Mayor Rusty Knox, a veteran real estate agent with Allen Tate.

Mecklenburg County homeowners will receive official word this month what the county’s tax assessors have determined their property’s value is. This will be the

first revaluation since the flawed 2011 revaluation that saw careers come to an end in the tax assessor’s office.

The new assessments have been years in the making, according to county officials. Nearly 90 percent of individual properties have been evaluated.

“There will still be many who will be shocked and there may be many more who will be reassessing their personal budgets when they see an increase of 25 percent to 30 percent in their tax bill,” Knox says.

Local governments operate largely on property taxes calculated on market values. The assessor’s office literally inspects neighborhoods.

State law requires the County to conduct a property revaluation at least every eight years to determine its market value.

“Hopefully, this revaluation will bring those numbers to a better and more acceptable level of taxation,” Knox says. The goal of revaluation is to distribute the overall tax burden throughout the county in a way that is fair and equitable—and based on current property values.

From August to September, Charlotte-area prices rose 0.2 percent. From September to October, they rose 0.3 percent. The gains nationwide are slowing down and they’re expected to slow here as well. It’s becoming more of a balanced market, according to Pat Riley, CEO of Allen Tate.

Home sellers no longer have the upper hand.

The combination of higher mortgage rates and home prices rising faster than incomes means fewer people can afford to buy a house. Fixed rate 30-year mortgages are currently 4.75 percent, up from 4 percent a year earlier.

Meanwhile, home prices are up on the order of 50 percent from the bottom of the market in 2012.

“Reduced affordability is slowing sales of both new and existing single family homes,” says David M. Blitzer, managing director at Case-Shiller, part of the S&P Dow Jones Indices.

Sales peaked in November 2017 and have drifted down since. So now assessments will soar. Nothing will be due until September, some three months after local governments set the budget for their upcoming fiscal years. The new property taxes must be paid by Jan. 7 of next year.

While valuations may soar, property taxes might not.

Tax rates will be determined during the budgeting season which gets under way in earnest during late winter/early spring. Budgets—and tax rates—will be finalized by the time the new fiscal year begins July 1.

Jason Gentry, broker in charge at the Sotheby’s International Realty office in Cornelius, is the immediate past president of the Charlotte Regional Realtor Association. He’s been on the front lines of the epic price gains in Lake Norman and Charlotte.

Gentry suggests the tremendous in-migration over the past 10 years, coupled with a large number of new commercial development, means a bumper crop of new ratables. That means more properties to tax.

It might not be as bad as some people say. Indeed, local governments must publish a “revenue neutral” rate—what taxes would be without an increase in revenue due to the higher valuations.

Nevertheless, he predicts the revaluations will prod Baby Boomers—notoriously sitting on family-size and high-end properties well into retirement age—to downsize.

Gentry is predicting 2019 will be another “positive year” in the real estate business. “The worst case scenario is we will just maintain what happened in 2018,” he says.

Charlotte has a glow on it that even the prestigious Robb Report has noticed. The luxury-lifestyle magazine features Rolls Royces, private jets, yachts and real estate .

While top luxury real estate markets like New York City slowed down last year, the Robb Report see other markets gaining speed for high-net-worth buyers in the next year.

The Robb Report’s hot markets for 2019: Paris, Tokyo, Miami, Singapore…and Charlotte, N.C.

If you disagree with your valuation

Start by visiting www.mecknc.gov/AssessorsOffice/MeckReval

Informal Review – You have 30 days from the date you received your Notice of 2019 Real Estate Assessed Value to request an Informal Review. This allows you and an assessor to review the property record and supporting information together. If an error is found, it can be corrected without having to go to a Formal Appeal. More info: 704-336-7600.

Formal Appeal – If you believe your 2019 Notice of Real Estate Assessed Value is not a reasonable estimate of what your property could sell for on Jan. 1, 2019, you also have the right to file a Formal Appeal by May 20, 2019.

Discussion

No comments yet.