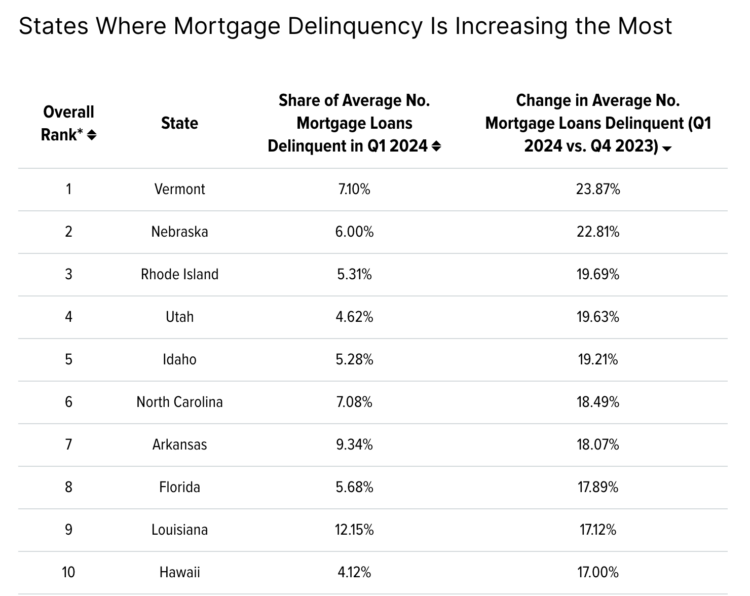

May 23. With the rate of mortgage delinquency rising in all 50 states, a new WalletHub study says North Carolina ranks sixth among the states where mortgage delinquency is increasing the most.

From the fourth quarter of 2023 to the first quarter of 2024, delinquencies in North Carolina rose 18.49 percent. The smallest increase was in New Hampshire with a 4.68 percent increase during the same time frame.

Vermont is the state where mortgage debt delinquency is increasing the most. Around 24 percent more mortgages in the state were delinquent in Q1 2024 than in Q4 2023, the highest increase in the country.

Quotable

“If you are delinquent on mortgage debt, you typically have until the debt is 30 days past-due (meaning you have missed two payments) in order to get current. After that, the lender will report the delinquency to the credit bureaus, which will damage your credit score. Therefore, it’s important to try to get current on your debt as quickly as possible. If you are experiencing financial difficulty that prevents you from paying, ask your lender if they will allow temporary forbearance until you get back on your feet, which may prevent you from being reported as delinquent.”

—Cassandra Happe, WalletHub analyst

Click here for the full report.

Source: WalletHub

Discussion

No comments yet.