Source: Federal Reserve Bank of NY

Dec. 12. Consumers started 2022 by paying down just $12.5 billion in new debt in the first quarter, adding a staggering $67.2 billion in new debt during the second quarter, a Q2 record, followed by an additional $39.6 billion in the third, a Q3 record.

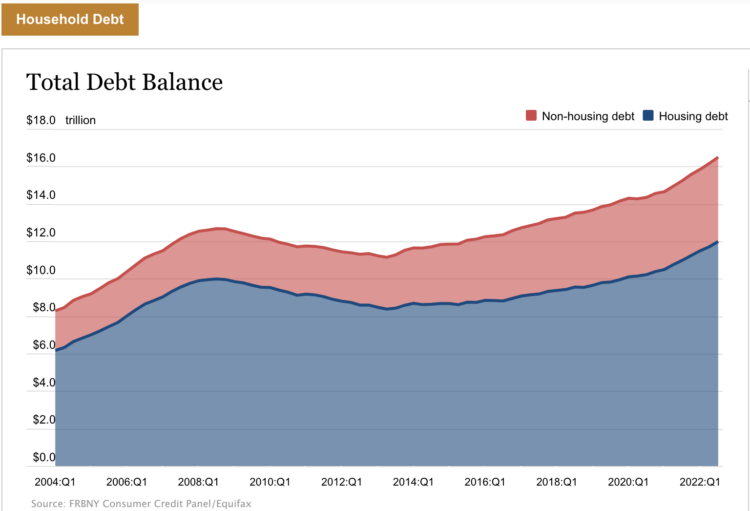

Mortgage balances—the largest component of household debt—climbed by $282 billion and stood at $11.67 trillion at the end of September, according to the Federal Reserve Bank of New York.

They said a 15 percent year-over-year increase in credit card balances marked the largest in more than 20 years. The share of current debt transitioning into delinquency increased for nearly all debt types, following two years of historically low delinquency transitions.

Background

The average US household has over $8,900 in credit card debt, up 4.5 percent from the previous year.

With inflation putting pressure on people’s budgets and raising concerns about a prolonged recession, WalletHub released its latest Credit Card Debt Study, Federal Reserve Rate Hike Report.

Fed rate hike survey key findings

—Fed increases affecting wallets. 63 percent of Americans say their wallets have been affected by the Fed’s rate hikes this year.

—Inflation concerns. 2 in 3 Americans think inflation is going to be worse in 2023.

—Elections won’t make a difference. Almost 3 in 4 people think the recent elections will not help tame inflation.

—Not recession-ready. 49 percent of Americans say they are not financially prepared for a recession.

—Deflated holiday plans. 54 percent of Americans say inflation has affected their holiday plans.

—Monthly expenses affected. 68 percent of people say inflation has affected their monthly grocery expenses the most, followed by gas (23 percent) and housing (9 percent).

Credit card debt study key stats https://wallethub.com/edu/sa/fed-rate-hike-survey/48053

—Record Q3 Increase. Credit card debt increased by almost $39.6 billion during Q3 2022, an all-time record for the third quarter of the year.

—Bigger-Than-Normal Buildup. Consumers’ Q3 2022 credit card debt increase was 2.4X bigger than the post-Great Recession average for a third quarter.

—Record Annual Projection. WalletHub projects that consumers will end the year with roughly $110 billion more in credit card debt than they started with, which would be close to an annual record.

—More Costly Debt. A Federal Reserve interest rate increase on December 14 would cost people with credit card debt at least an extra $3.2 billion in the next year alone. That’s on top of the $22.9 billion increase already caused by the Fed’s previous rate hikes this year.

Tips for managing credit card debt

Make a budget and stick to it: It’s difficult to spend within reason or plan savings if you don’t know how your monthly spending compares to your take-home pay, or where that money is going. That is why you should rank-order your expenses – including debt payments, emergency fund contributions and other savings – and trim the fat, if necessary. Most importantly, once you develop your budget, make sure to stick to it or else you’ll have simply wasted your time.

Build an emergency fund: With a safety net of cash to fall back on, you won’t be as likely to fall behind on your bills in the event of emergency expenses or unplanned joblessness. Your goal should be to gradually save about a year’s worth of after-tax income. In other words, set aside a little bit every month until you’ve got a nice cushion.

Improve your credit: This might sound a bit counterintuitive, seeing as more credit could mean more debt. But improving your credit standing will have a dramatic impact on the cost of your debt. And reducing the cost of your debt will allow you to pay it off faster. Better credit can also make it easier to find a job or a place to live, both of which impact your bottom line.You can check your latest credit score for free and get personalized credit-improvement tips on WalletHub.

Try the island approach: The Island Approach is a strategy that involves using a collection of credit cards, with each serving a specific purpose. For example, you could transfer your existing debt to a 0 percent balance transfer credit card to save on finance charges and get out of debt sooner. And you could use a rewards card or two – perhaps one with travel rewards and one with cash back, or maybe a store credit card – for purchases that you’ll be able to pay off by the end of the month.This will enable you to get the best possible collection of terms. It will also tell you when you’re overspending. Finance charges on your everyday spending cards will signal a need to cut back.

Repay most expensive debt first: Most people with serious credit card debt have multiple balances. If that’s the case for you, try the “avalanche method.” That means putting the majority of your monthly debt payment toward the balance with the highest interest rate and making the minimum payment required on the rest. Once your most expensive debt is paid off, repeat the process until you’re debt-free.

Evaluate job situation: In some cases, all the budgeting and planning in the world won’t be enough to solve your debt problems. You may need to explore whether higher-paying opportunities exist for people with your background or consider acquiring some new skills to make yourself more marketable. This may require a bit of an investment in yourself, but as long as you get a worthwhile return, it’s money well spent.

Discussion

No comments yet.