Cornelius Bromont changed the name of the Village of Lake Norman to Augustalee in 2008. The $515 million project included 655,000 square feet of restaurant/retail space, 810,000 square feet of office space, two hotels and 400 residential condominiums, as seen in this rendering. The lender foreclosed 10 years ago on the original developer.

June 11. By Dave Yochum. One of the most significant development sites in Lake Norman is under contract, years after the original project—known as Augustalee—flamed across the economic development sky into foreclosure. The sale price and buyer likely won’t be disclosed until after a 150-day due diligence period is completed.

Executives at Concord-based ACN purchased the 110-acre Augustalee property for $7.3 million in 2012 after Fifth Third Bank took it back from Bromont Investments, the original developer a decade ago.

The property had been on the market at $22 million. Sources said the contract price is $20 million.

WALT RECTOR

Bromont, based in Scottsdale, Ariz., paid an astonishing $34 million to members of the Cook family who had farmed the property actively until about 2006.

Plans back in 2006-2007 called for a 1.4 million-square-foot mixed-use project dubbed The Village at Lake Norman in Cornelius. Similar in concept to Birkdale to the west on Hwy. 73, the Village had 500,000 square feet of office space, not to mention 840,000 square feet of retail and 440,000 square feet of residential.

The name morphed into Augustalee, and the project became the talk of the economic development world. Walt Rector, a noted equestrian, planned on partial reimbursement through a development grant for a $40 million exit off Interstate 77 dubbed Exit 27. The grant would have been based on funds generated by the increased tax revenue the project could generate.

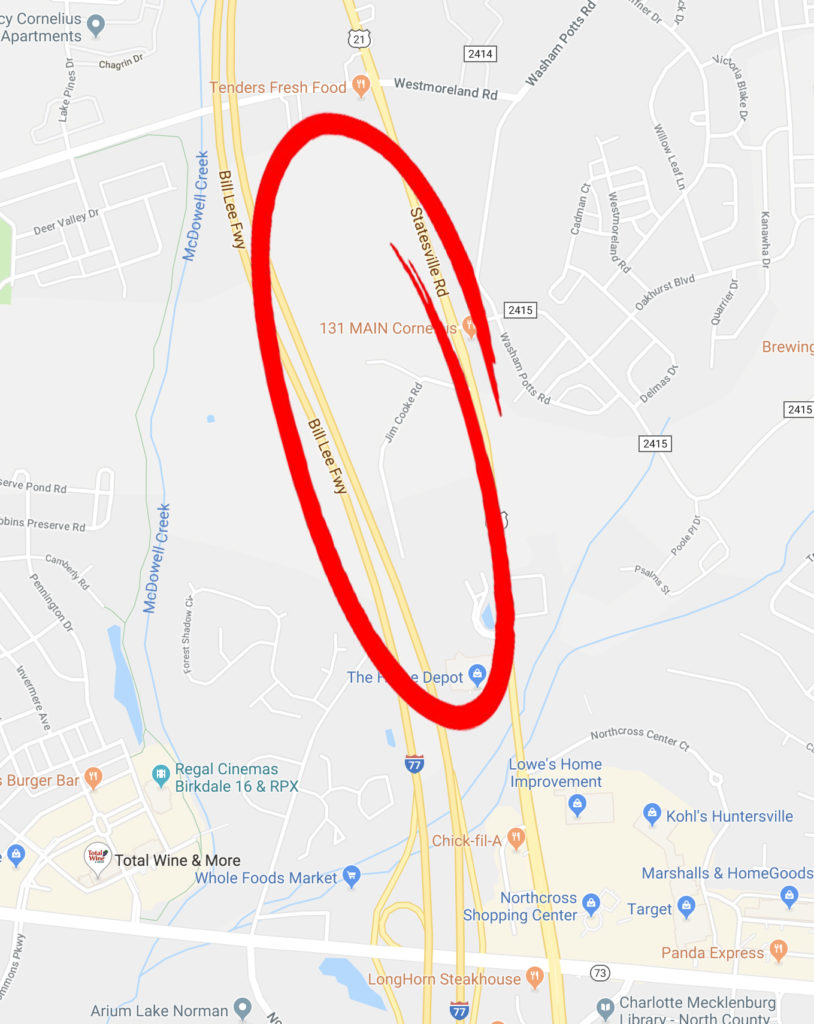

Augustalee fronted on I-77 between Exit 25 and Exit 28, but it needed the new interchange at Westmoreland Road on the northern end of the lyrically named property.

While a new Exit 27 is not part of NCDOT planning, the Town of Cornelius is in fact working with Kimley-Horn design consultants on the development of an

AUGUSTALEE IS LOCATED OFF OF I-77 BETWEEN WESTMORELAND AND 73

Interchange Access Report. They’re necessary to obtain approval from Federal Highway Administration and NCDOT for a new interchange at the Westmoreland overpass.

“We are about halfway through the process to reach the final report,” said Andrew Grant, Cornelius town manager.

A new Exit 27 interchange is considered essential to “unlocking the commercial development potential of the study area,” according to a 2015 Lake Norman Economic Development study drafted by the Urban Land Institute. The study went on to say that a traditional single-point urban interchange at Westmoreland Road would “not serve the best interests of all parties involved,” suggesting that a more complex “Square” interchange or “Counterchange” could create a signature gateway to the community.

A similar design was used in 2011 in Gloucester Township, N.J., for an interchange on Route 42, a limited access highway that runs from Philadelphia to Atlantic City

Cornelius experienced tremendous growth between 2000 and 2010, more than doubling in population from 11,969 to 24,866, but the town has experienced relatively little non-residential growth over the years, according to the ULI report.

Bromont had planned a Ballantyne-like mixed-use development, with Class A office space for “corporate relocation, some retail and some residential.”

There would have been luxury condos, hotels and office and retail space, not to mention underground parking.

Indeed, the mixed-use project was expected to employ more than 4,000 workers, but a new freeway exit was needed to pull it all together and provide ready access for commuters.

The Rectors wowed Cornelius with a refined personal style that included racing four-in-hand carriages

Of course the real estate market collapsed, sealing Augustalee’s fate.

Fifth Third Bank was the senior lender on the proposed $155 million, mixed-used development; the BUILD Fund was the secondary lender until foreclosing on the original developers, Cornelius Bromont and Bromont Investments, in August of 2009.

At a foreclosure sale, the BUILD Fund was the sole bidder for Augustalee, offering $2.5 million. The fund had already advanced the development $19 million.

The site is considered a trophy in the world of commercial real estate development.

It’s unknown whether any of the ACN-related companies would participate somehow in a new Augustalee project 10 years later.

Discussion

No comments yet.